Watch video summary

Schedule a Free Consultation Call Today

Discover how we can help you overcome, the latest payment challenges.

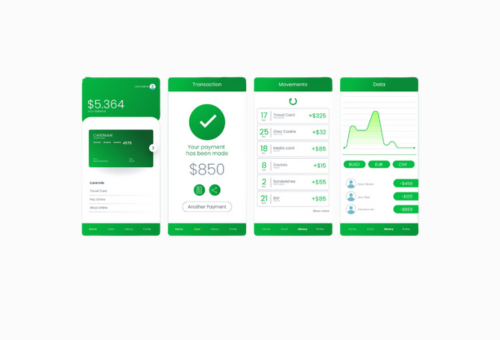

A smooth payment interface can make the difference between a completed sale and a lost customer. At Facilero, we believe that well‑designed payment interfaces are the cornerstone of customer trust and business growth. By focusing on usability, technology, and continuous improvement, businesses can turn payment flows into strategic assets rather than necessary hurdles.

Why Payment Interface Usability Matters

When users encounter friction at checkout, even loyal customers may abandon their carts. A usable payment interface reduces hesitation and error, guiding customers confidently through final steps.

Impact on Conversion Rates

Clear calls to action, concise form fields, and immediate feedback all contribute to higher conversion rates. Research shows that reducing the number of input fields by even one can lift conversions by several percentage points. That incremental gain translates into significant revenue when scaled across thousands of transactions.

Influence on Customer Loyalty

A seamless payment experience builds confidence. Customers who complete a transaction without hiccups are more likely to return and recommend the service to others. Repeated positive interactions with the interface reinforce brand credibility and loyalty over time.

Core Principles of User‑Friendly Payment Interfaces

Every element of the checkout flow should serve clear, user‑centered goals. At Facilero, we emphasize simplicity, consistency, and transparency in every design decision.

Simplified Navigation and Clear CTAs

Buttons labeled “Pay Now” or “Confirm Purchase” eliminate doubt about the next step. Grouping related fields, such as billing and shipping information, prevents unnecessary toggling between sections.

Responsive Design Across Devices

With mobile transactions surpassing desktop in many sectors, payment interfaces must adapt to various screen sizes. Responsive layouts ensure buttons remain tappable, forms remain legible, and the overall flow stays intuitive on smartphones, tablets, and desktops alike.

Transparent Pricing and Fee Disclosure

Hidden fees are a quick way to undermine trust. Displaying total costs—including taxes, shipping, and processing fees—before final confirmation gives customers full visibility and reduces post‑purchase disputes.

Technological Enablers

Modern payment interfaces rely on robust technology stacks. From data standards to smart integrations, these enablers power seamless user experiences.

Real‑Time Processing and ISO 20022 Messaging

Implementing real‑time processing ensures funds move instantly, reducing wait times and currency exposure. Adopting ISO 20022 messaging allows richer transaction data to flow between institutions, boosting reconciliation accuracy and dispute resolution speed.

AI‑Driven Personalization and Fraud Detection

AI models can tailor the checkout experience by recognizing returning customers and pre‑filling known details. Meanwhile, machine learning monitors transaction patterns in real time, flagging anomalies and preventing fraud without imposing extra verification steps on legitimate users.

API‑First Integrations for Seamless Workflows

APIs enable payment modules to plug directly into e‑commerce platforms, accounting systems, and customer portals. This modular approach lets businesses launch new payment options without overhauling the entire backend.

UX Strategies to Enhance Engagement

Beyond the basics, thoughtful UX touches can elevate the payment experience from functional to memorable.

Dynamic Micro‑Animations for Feedback

Subtle animations—like a checkmark that appears after card details are accepted—provide reassurance that the system is processing correctly. These micro‑interactions reduce uncertainty and keep users informed.

Contextual Financial Guidance

Inline guidance, such as clarifying why a CVV code is needed or providing examples for date formats, prevents form‑completion errors. This contextual help reduces customer support inquiries and frustration.

Accessible Design and Inclusive Features

Color contrast, keyboard navigation, and screen‑reader compatibility ensure that users with disabilities can complete payments smoothly. Inclusive design broadens your customer base and aligns with legal accessibility standards.

Measuring Success

Continuous improvement depends on clear metrics and a culture of experimentation.

Key Performance Indicators for UX

Track metrics such as checkout abandonment rate, error rate per field, time to complete payment, and post‑purchase support tickets. These KPIs reveal usability bottlenecks and inform prioritization.

A/B Testing and Iterative Refinement

Testing different button labels, form layouts, or security prompts uncovers what resonates best with your audience. Small tweaks can yield measurable gains in conversion and satisfaction.

Future Trends in Payment Interface Design

Looking ahead, emerging trends will reshape how businesses collect payments and build loyalty.

Voice and Conversational Payments

As voice assistants become more capable, paying via spoken commands or chatbots will grow. Designing interfaces that support these channels ensures early mover advantage.

Biometric Authentication Flows

Fingerprint and facial recognition streamline authentication, reducing reliance on passwords or manual input. Secure biometric checks can boost completion rates while maintaining compliance.

Embedded Finance Experiences

Embedding payment capabilities directly within non‑financial platforms—like messaging apps or social networks—eliminates context switching. Users stay within familiar environments, driving convenience and repeat use.

Payment interfaces are more than a final step in the sales funnel—they reflect your brand’s commitment to customer experience and operational excellence. At Facilero, we’ve seen firsthand how even modest interface improvements can translate into sizable business impact. By prioritizing usability, leveraging modern standards, and committing to ongoing optimization, you can build payment flows that not only convert but also cultivate lasting trust.

How Can Facilero Help You?

When it comes to managing payments, you need a partner who gets the job done—no fuss, no guesswork. At Facilero, we understand that every transaction matters. That’s why we focus on delivering payment solutions that are not only robust and secure but also flexible enough to fit the way you do business.

Built for Business Growth

Whether you’re scaling up or fine-tuning daily operations, Facilero’s infrastructure grows with you. You won’t get stuck wrestling with outdated systems or waiting on manual processes. Instead, you’ll enjoy streamlined workflows that free up your team to focus on strategy, not on chasing down approvals or fighting reconciliation headaches.

Security You Can Count On

Let’s be honest—security isn’t a nice-to-have; it’s non-negotiable. We’ve baked in advanced fraud detection, encryption, and compliance controls so your data stays protected and your audits stay smooth. You can rest easy knowing every payment runs through a shield of best-in-class safeguards.

Support That Has Your Back

Ever been left hanging when you needed support most? That won’t happen here. Our dedicated team is just a call or message away, ready to tackle any hiccup—big or small. We pride ourselves on fast, friendly service that keeps your operations humming.

In today’s fast-paced market, having reliable, adaptable payment solutions isn’t optional—it’s critical. Let Facilero handle the complexity so you can concentrate on driving revenue and delighting customers.

Contact us now and let us help take your business to the next level!

Get A Free Consultation

Book a free call with us to discuss how we can help you expand in new regions, scale, and get the cash flowing in your business.